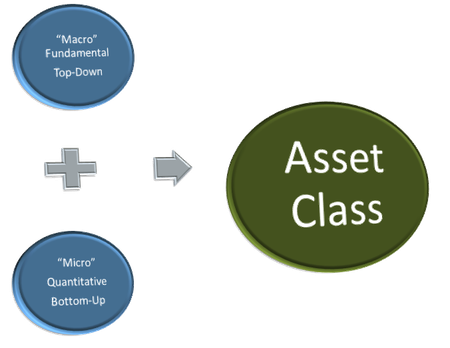

"Macro" Fundamental Top-Down

- Identify from our global asset class universe, which asset classes will benefit from economic, social, and political tailwinds and which will suffer from economic, social, and political headwinds.

- Examples of the global factors in our research include monetary policy, fiscal policy, inflation, unemployment, and consumer confidence.

"Micro" Quantitative Bottom-up

- Identify which asset classes are undervalued, fairly valued, or overvalued.

- We calculate relative and absolute valuation from Price-to-Earnings, Price-to-Book, Earnings Per Share, and Dividend Yield data.